Singapore’s Semiconductor Surge: The AI Driven Talent Boom Every Company Must Prepare For

This article is written in English for readers in Singapore. Chinese and Japanese translations are available on our website.

Singapore’s semiconductor sector is reshaping its position in the global tech economy. With rising demand for AI hardware, smart manufacturing, and high-precision engineering capabilities, the country is strengthening its role as one of the world’s most resilient and advanced chipmaking hubs.

The next wave of talent demand is already here. Companies across wafer fabrication, equipment manufacturing, automation, testing, and advanced electronics are accelerating hiring plans to keep pace with regional and global growth. This article highlights the key forces shaping Singapore’s semiconductor surge and what companies must prepare for as talent needs intensify in 2025 and beyond.

1. Singapore is entering a new phase of semiconductor expansion

Semiconductors remain one of Singapore’s most important manufacturing pillars. The sector forms a significant share of the national economy and contributes to high-value exports and advanced manufacturing capabilities.

Key trends strengthening Singapore’s leadership include:

Strong global relevance

Singapore contributes an estimated seven percent of the global semiconductor market. The country is viewed as one of the most stable and innovation-ready manufacturing hubs in Asia, attracting firms looking for supply chain resilience and skilled engineering talent.

Government support for AI and advanced manufacturing

National initiatives such as RIE2025 and strategic EDB investments continue to strengthen chip production, automation, testing, and next-generation electronics.

Rising employment demand

More than thirty seven thousand professionals are employed across semiconductor and precision engineering roles. Hiring needs remain strong across wafer fabrication, backend assembly, automation, testing, equipment maintenance, design, and yield improvement.

These foundations have created a strong platform for the next stage of Singapore’s chip industry expansion, especially as the global economy enters the age of AI.

2. AI is reshaping semiconductor hiring needs

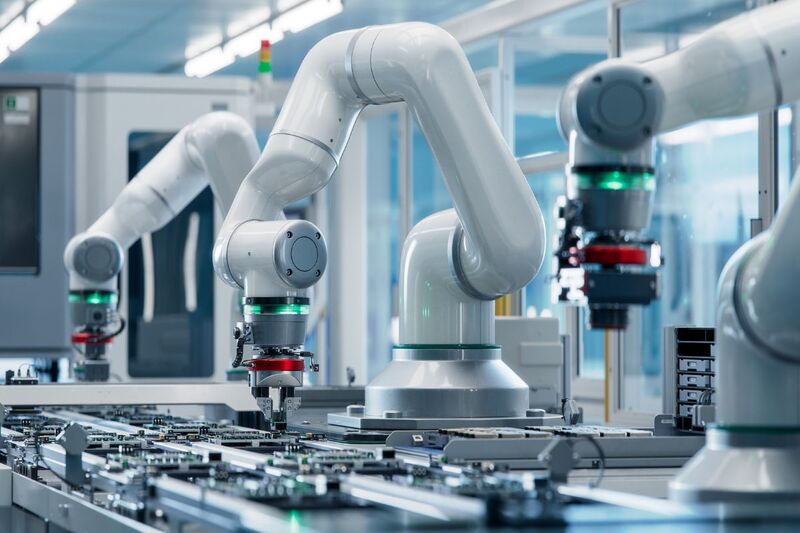

As companies adopt AI-driven tools, manufacturing automation, and advanced robotics, new job families are emerging across the semiconductor ecosystem.

Roles that will see increased demand include:

- AI Integration Engineers

- Automation Engineers

- Process Technologists

- Yield Enhancement Specialists

- Equipment Engineers

- Industrial Software Engineers

- Data Analysts for Manufacturing Operations

Companies are also building cross-functional teams that combine engineering, data, software, and production optimisation skills. This shift is driving stronger demand for candidates with hybrid capabilities and multi-disciplinary experience.

3. Global chipmakers are expanding their Singapore footprint

Many semiconductor and precision engineering firms are strengthening operations in Singapore, leading to increased hiring across engineering, testing, QA, and equipment maintenance.

Based on market observations and ongoing hiring activity, key drivers include:

Diversification of supply chains

Global companies continue expanding production capacity in Singapore to reduce manufacturing risk and strengthen operational continuity.

Growth in advanced electronics and equipment manufacturing

Companies in testing, packaging, automation systems, and specialty equipment continue to create new engineering and technical roles.

Higher investment in sustainable and efficient manufacturing

More companies are seeking engineers with skills in energy optimisation, system efficiency, predictive maintenance, and environmentally responsible production processes.

As companies diversify their regional footprints, Singapore remains a trusted hub for high-value production and engineering excellence.

4. What Singapore companies must prepare for in 2025 and beyond

Talent competition in the semiconductor space continues to intensify. To stay competitive, companies in Singapore should prepare for the following shifts:

a. Growing demand for specialised engineering talent

Candidates with specific equipment, wafer fabrication, automation, or quality experience will continue to be in high demand.

b. Rising interest in cross-disciplinary talent

Roles that combine hardware, software, and data competencies will become more common, especially in AI and Industry 4.0 production.

c. Increased need for internal upskilling

More companies will invest in structured training to help engineers expand into automation, robotics, predictive maintenance, and data analysis.

d. Greater emphasis on employer branding

To attract high-performing engineers, companies will need to highlight their work environments, career pathways, and innovation culture.

e. Stronger demand for bilingual or cross-cultural hires

Many semiconductor firms in Singapore are headquartered in the United States, Europe, Taiwan, Korea, and Japan. Ability to work across cultures remains a competitive advantage.

5. How semiconductor companies can stay ahead in hiring

Here are practical steps companies can take to attract stronger engineering and technical talent:

- Strengthen visibility on professional platforms such as LinkedIn

- Improve job descriptions with clear skill maps and career pathways

- Offer structured development, mentorship, and learning programmes

- Highlight innovation projects, automation upgrades, and AI initiatives

- Work with recruitment partners that specialise in engineering and high-tech roles

Companies that move early will be better positioned to secure key engineering talent before competitors intensify hiring efforts.

Frequently Asked Questions (FAQ)

What engineering roles are most in demand in Singapore’s semiconductor industry?

Process, equipment, automation, quality, yield improvement, and AI integration roles are seeing strong and sustained hiring demand.

Why are global semiconductor firms expanding in Singapore?

Companies value Singapore’s stability, talent pool, research ecosystem, supply chain reliability, and government support for advanced manufacturing.

Will demand for semiconductor talent continue to rise?

Yes. AI adoption, automation, and the next growth cycle in global chip investment will continue to drive demand for specialised engineering talent in Singapore.

Do companies need multilingual or cross-cultural talent?

Many semiconductor firms operate in global teams. Experience working with Japan, Taiwan, US, EU, or Korean teams is increasingly valuable.

If your company is expanding in semiconductor or precision engineering, our advisers can help you build a strong pipeline of skilled engineers.

👉 Connect with our client team here.

If you are an engineer exploring new opportunities in Singapore, our consultants can guide you on the latest roles and industry trends.

👉 Submit your profile here to speak with a consultant.

✅ Final Author Credit

By Valerie Ong (Regional Marketing Manager)

Published by Reeracoen Singapore — a leading recruitment agency in APAC.

Related Articles

- Singapore Labour Market 2025 Hiring Slows But Opportunities Rise — What It Means for You

- Navigating Economic and Tech Signals in 2025: What Singapore’s Job Market in AI, Data, and Finance Reveals

- Upskilling in the Age of AI & Green Jobs: Why Singapore Must Prepare Now

Reference Links

- EDB industry updates

- SSIA insights

- MOM Labour Market trends

- RIE2025 initiatives’

Disclaimer:

The information provided in our blog articles is intended for general informational purposes only. It is not a substitute for professional advice and should not be relied upon as such.

While we strive to provide accurate and up-to-date information, the ever-evolving nature of certain topics may result in content becoming outdated or inaccurate over time. Therefore, we recommend consulting with qualified professionals or experts in the respective fields for specific advice or guidance. Any actions taken based on the information contained in our blog articles are solely at the reader's discretion and risk. We do not assume any responsibility or liability for any loss, damage, or adverse consequences incurred as a result of such actions.

We may occasionally provide links to external websites or resources for further information or reference. These links are provided for convenience and do not imply endorsement or responsibility for the content or accuracy of these external sources. Our blog articles may also include personal opinions, views, or interpretations of the authors, which do not necessarily reflect the views of our organisation as a whole. We encourage readers to verify the accuracy and relevance of information presented in our blog articles and to seek professional advice when needed. Your use of this website and its content constitutes acceptance of this disclaimer.