Singapore Budget 2026: A Turning Point for Hiring, AI and Workforce Transformation

Source: Entertainment - Mediacorp’s YouTube

By Valerie Ong, Regional Marketing Manager

Published by Reeracoen Singapore, a leading recruitment agency in APAC.

Language

This article is written in English for readers in Singapore. Chinese and Japanese translations are available on our website.

Why Budget 2026 Matters for Employers and Professionals

Singapore Budget 2026 places strong emphasis on workforce resilience, wage progression, AI adoption and long-term economic competitiveness.

Total operating revenue is projected at $134.75 billion, while total expenditure is estimated at $137.32 billion, reflecting continued investment in growth and social stability. Corporate Income Tax revenue is projected at $37.77 billion, suggesting sustained business activity across sectors.

This is not a contractionary budget. It is a strategic recalibration of Singapore’s workforce and competitiveness model.

For employers and professionals alike, the implications extend well beyond tax rebates.

Key Workforce and Business Changes in Budget 2026

1. Wage and Lower-Income Worker Support

| Measure | Change | Effective Date | Workforce Impact |

|---|---|---|---|

| Local Qualifying Salary | Raised to $1,800 | July 2026 | Higher wage floor |

| Progressive Wage Credit Scheme | Enhanced co-funding | 2026 to 2028 | Cost offset for employers |

| Workfare Skills Support | Enhanced Basic Tier | 2026 | Stronger skills progression |

Implication: Entry-level and operational salary structures require review before July 2026.

2. Foreign Manpower Adjustments

| Category | New Minimum | Effective | Planning Consideration |

|---|---|---|---|

| Employment Pass | $6,000 | 2027 | Higher cost for mid-level foreign professionals |

| S Pass | $3,600 | 2027 | Budget recalibration |

| Work Permit Levies | Adjusted | 2028 | Long-term cost modelling |

Implication: Workforce localisation and succession planning will become more important.

3. AI as a National Strategic Priority

Budget 2026 reinforces AI adoption across sectors through:

- Establishment of a National AI Council

- Expansion of Enterprise Innovation Scheme to include AI expenditure

- Expanded Productivity Solutions Grant for AI-enabled tools

- National AI Missions across manufacturing, finance, healthcare and connectivity

Case studies show measurable productivity improvements, including reduced call handling time and significantly faster internal reporting.

Implication: AI literacy is transitioning from competitive advantage to operational necessity.

4. SkillsFuture and Mid-Career Mobility

Budget 2026 strengthens Singapore’s skills-based economy:

| Programme | Update | Workforce Effect |

|---|---|---|

| SkillsFuture Level-Up | Expanded course coverage | More industry-relevant training |

| Senior Employment Credit | Extended to 2027 | Encourages mature workforce retention |

| TechSkills Accelerator | Expanded AI pathways | Supports digital transition |

Implication: Mid-career mobility and reskilling will accelerate across industries.

5. Business Cost Support

| Measure | Details |

|---|---|

| Corporate Income Tax Rebate | 40 percent for YA2026 |

| Rebate Cap | $30,000 |

| Minimum Benefit | $1,500 for active companies with one local employee |

| SME Grant Support | Up to 70 percent for overseas expansion |

Implication: Short-term cost relief supports hiring continuity and expansion.

Top 10 Workforce Implications of Budget 2026

1. Entry-level wage floors will rise.

2. Foreign manpower thresholds will increase from 2027.

3. AI adoption will accelerate across sectors.

4. Mid-career reskilling demand will increase.

5. HR and finance planning must be integrated.

6. SMEs gain stronger overseas expansion support.

7. Compliance and governance roles remain relevant.

8. Productivity improvements will increasingly rely on technology.

9. Skills-based hiring becomes more important.

10. Workforce competitiveness becomes a long-term structural priority.

Budget 2026 reflects transformation rather than temporary adjustment.

Sector-Level Impact Overview

| Sector | Budget Signal | Likely Hiring Trend |

|---|---|---|

| BFSF | AI governance and regulatory focus | AI, risk and compliance growth |

| Manufacturing | National AI Missions | Digital operations hiring |

| Technology | Enterprise Innovation Scheme expansion | AI engineering demand |

| SMEs | Higher grant support | Regional expansion roles |

| Services | Wage floor adjustments | Salary restructuring |

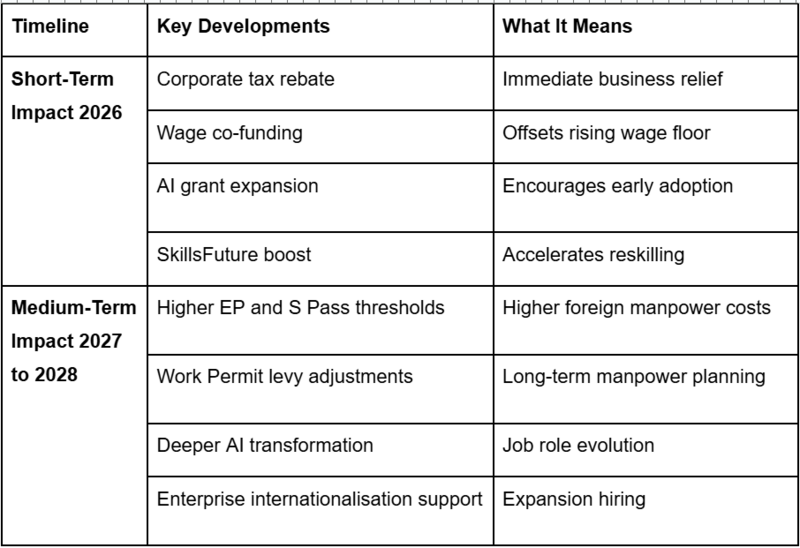

Budget 2026 Workforce Cheat Sheet

Budget 2026 signals structural competitiveness and sustained workforce upgrading.

What Employers Should Do Now

To stay competitive under Budget 2026, employers should:

- Audit wage structures ahead of the July 2026 adjustments

- Model the financial impact of Employment Pass and S Pass threshold changes

- Identify practical AI integration opportunities across operations

- Align HR planning closely with financial forecasting

- Strengthen internal reskilling and succession pathways

Proactive workforce planning will help organisations manage cost adjustments while unlocking productivity gains.

What Professionals Should Focus On

Under Singapore’s evolving workforce landscape, professionals should prioritise:

- Building AI and digital literacy

- Leveraging SkillsFuture Level-Up programmes for industry-relevant training

- Strengthening transferable and cross-functional skills

- Expanding exposure beyond core functional roles

- Positioning mid-career shifts strategically

Singapore’s direction increasingly rewards adaptability, skills progression and continuous learning.

Frequently Asked Questions

Is Budget 2026 expansionary?

Yes. Total expenditure is projected to increase by 10.3 percent year-on-year.

Will hiring costs increase?

Entry-level wage floors and foreign manpower thresholds will increase baseline manpower costs in certain segments.

Is AI support only for large enterprises?

No. SMEs can access expanded Productivity Solutions Grant and Enterprise Innovation Scheme support.

Should mid-career professionals reskill now?

Yes. Expanded SkillsFuture pathways signal strong policy backing for career mobility.

For Employers

Align your 2026 hiring strategy with Singapore’s workforce direction.

For Professionals

Future-proof your career in Singapore’s evolving job market.

👉 Submit your CV to Reeracoen Singapore to explore opportunities aligned with growth sectors.

Related Articles

Continuous Learning in Singapore: How Upskilling Improves Employability in 2026

End of Q1 2026: Are Singapore Employers on Track With Hiring and Retention?

Top In-Demand Jobs in Singapore in 2026: Skills, Salaries and Hiring Trends

References

- Ministry of Finance Singapore, Budget 2026 Statement and Annexes

- FY2026 Fiscal Position Report

- Singapore Budget 2026 Infographics and Official Budget Booklet

Disclaimer:

The information provided in our blog articles is intended for general informational purposes only. It is not a substitute for professional advice and should not be relied upon as such.

While we strive to provide accurate and up-to-date information, the ever-evolving nature of certain topics may result in content becoming outdated or inaccurate over time. Therefore, we recommend consulting with qualified professionals or experts in the respective fields for specific advice or guidance. Any actions taken based on the information contained in our blog articles are solely at the reader's discretion and risk. We do not assume any responsibility or liability for any loss, damage, or adverse consequences incurred as a result of such actions.

We may occasionally provide links to external websites or resources for further information or reference. These links are provided for convenience and do not imply endorsement or responsibility for the content or accuracy of these external sources. Our blog articles may also include personal opinions, views, or interpretations of the authors, which do not necessarily reflect the views of our organisation as a whole. We encourage readers to verify the accuracy and relevance of information presented in our blog articles and to seek professional advice when needed. Your use of this website and its content constitutes acceptance of this disclaimer.